i met with Mark Williams at Williams Lynch Estate Agents in Bermondsey Street to discuss what the New Year will bring in terms of property prices and expectations across SE1 in 2013. As the MD of an agency approaching its 15th year of trading in the area Mark is well placed to predict the trends in both sales and lettings.

As he said himself, “Although the Bermondsey Street area has changed physically since early 1998 the most noticeable difference for me is the obvious increase in the number of people on the street at any one time compared to then. I remember the area seemed much quieter and a little unloved before a splash of brilliant orange arrived in the form of the Zandra Rhodes Fashion & Textile Museum. Since then the regeneration and gentrification of the area has been amazing.”

“Every year brings about a change that has a dramatic effect on property prices and 2013 will be no different. SE1 is still relatively inexpensive compared to other now fashionable areas of London such as Wapping, Clerkenwell and Shoreditch.”

“When Williams Lynch opened in 1998 we were selling units in a development called Leathermarket Court in Leathermarket Street at £190.00 per square foot. Compare that to this year when we recently we sold a two-bedroom apartment in the same development and achieved a price of £685 per square foot. Typical values now on Bermondsey Street are between £750 and £850 per square foot.”

“New Homes developments planned for 2013 are likely to be marketed at £825 per square foot.” No wonder Mark is buoyant about sales and rental opportunities for next year.

“Every year brings about a change that has a dramatic effect on property prices

“It’s a great time to sell in SE1 right now due to the tremendous media attention the area is receiving as a result of the Shard and redevelopment of London Bridge Station. However, the various new developments coming on stream in 2013 will inevitably increase the number of properties available to buyers and therefore make the market more competitive for sellers.”

I asked Mark about the prospects at Shad Thames. “The demand for properties in Shad Thames is relentless as it provides an established safe haven for investors and continues to attract city professionals looking for secure developments with concierge facilities.”

“Any properties we have been instructed to sell or let in Shad Thames have generated such high levels of interest that asking price offers, and above, have been achieved. We occasionally use a discreet method of marketing which can often lead to surprising results as buyers and tenants seem attracted towards a property that few people are aware of.

So for sellers the message is this: capitalise now on high prices available from buyers hungry for great properties before lots of new units come onto the market over the next year or two.

For buyers there is a clear message: Property prices have a long way to go and next year will see good 5% increase in prices. Buy as quick as you can.

The first quarter of 2013 will be a great time to act in the lettings market too. Tenants will need to be quick off the mark to secure quality accommodation before the seasonal rush from mid-January to avoid competing with the rising demand from eager tenants.

Similarly for landlords the New Year is a great time to get your property on the market before the spring influx as generally there is little stock in the marketplace in the New Year and optimal rental values can be achieved for the ‘early birds’.

Williams Lynch

63 Bermondsey Street

SE1 3XF

t: 020 7940 9940

w: www.williamslynch.co.uk

-

TWO CLASSICS: The Shipwrights Arms and Simon the Tanner

Taking a look through the doors of our favourite local pubs

Category: Food&Drink -

2013 PROPERTY PRICES Great Expectations

Sales and lettings insights for the year ahead

Category: Property -

THE ART OF GIFTS at bermondsey 167

A concept born of two cultures

Category: Style -

NEVERMIND 'Jam On It', Here's Marmalade

Boutique Marmalade offers their style-savvy customers exactly what they want

Category: Style -

Dedicated Followers OF FASHION

An evening of Champagne and Absolutely Fabulous frocks

Category: Style -

A Surprise Dinner Party WITH GREGG WALLACE

A relaxed atmosphere at the Bermondsey Square Hotel with some great new dishes and a personal touch from Gregg and his team

Category: Food&Drink -

A NATIVITY SCENE Underneath the arches

We talk with Father Michael Cooley at Our Lady of La Salette and St Joseph Church about the history of local traditions

Category: For The Soul -

Art for the people BY THE PEOPLE

Bermondsey artist Austin Emery builds a community sculpture with the local residents of Tyers Estate, SE1

Category: Culture -

OLD FASHIONED Drinking

Tailored cocktails with modern twists

Category: Food&Drink -

A WINTER Hideaway

The sanctuary of the Quarter Bar and Lounge

Category: Food&Drink -

GET READY For a Party!

Introducing a Wicked Wardrobe range by Elly

Category: Style -

Shortwave BY LONG LANE

We meet up with Rob and Dean to view what’s new at the Shortwave cinema on Bermondsey Square

Category: Culture -

A POEM 'like a mind thinking'

The fruit of ideas

Category: For The Soul -

SHAD THAMES in the words of Charles Dickens

Walking through London streets and finding the lost souls that haunt the riverside

Category: Culture -

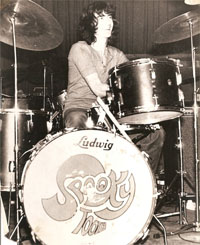

The Baltic JOURNEY

From 1780 until today, we take a look inside the changing space of 74 Blackfriars Road

Category: Food&Drink